El proyecto SII lanzado por la Agencia Tributaria Española (AEAT) corresponde a las siglas Suministro Inmediato de Información y es un sistema de declaración inmediata del IVA (impuesto sobre el valor añadido) a nivel electrónico en tiempo real.

Este proyecto implica un cambio radical en el sistema de gestión del IVA en España y es un elemento clave en la modernización de la Administración Pública en el marco estratégico de la transformación digital de la Administración.

Además de facilitar la gestión de los datos fiscales a los contribuyentes, el sistema SII mejorará el control tributario incidiendo así en la reducción del fraude fiscal.

Ventajas del Proyecto SII

Este nuevo sistema conlleva diferentes mejoras y ventajas para las empresas y sujetos pasivos:

-

Supresión de la obligada presentación de los modelos 347, 340 y 390. A partir de la entrada en funcionamiento del SII solo se deberán presentar las correspondientes autoliquidaciones del impuesto:

REDEME (Registro de Devolución Mensual del IVA.)

REDEME (Registro de Devolución Mensual del IVA.) GRAN EMPRESA

GRAN EMPRESA GRUPOS ENTIDADES

GRUPOS ENTIDADES RESTO (RÉGIMEN GENERAL)

RESTO (RÉGIMEN GENERAL)ENE FEB MAR ABR MAY JUN JUL AGO SEP OCT NOV DIC AUTOL MODELO 303 RESUMEN ANUAL 390 LIBROS REGISTRO MOD 340 DECLARO PER 3º MOD 347 *En naranja los trámites anulados. ENE FEB MAR ABR MAY JUN JUL AGO SEP OCT NOV DIC AUTOL MODELO 303 RESUMEN ANUAL 390 LIBROS REGISTRO MOD 340 DECLARO PER 3º MOD 347 *En naranja los trámites anulados. ENE FEB MAR ABR MAY JUN JUL AGO SEP OCT NOV DIC AUTOL MODELO 303 ITOL MOD 322 (RESTO ENTID)) JTOL MOD 353 (DOMINANTE) RESUMEN ANUAL 390 LIBROS REGISTRO MOD 340 DECLARO PER 3º MOD 347 *En naranja los trámites anulados. ENE FEB MAR ABR MAY JUN JUL AGO SEP OCT NOV DIC AUTOL MODELO 303 RESUMEN ANUAL 390 LIBROS REGISTRO MOD 340 DECLARO PER 3º MOD 347 *En naranja los trámites anulados. - Se suprime la obligatoriedad de elaboración de los Libros de Registro de IVA.

- Mejora en la elaboración de la declaración, reduciendo errores y permitiendo una simplificación y mejora de la seguridad jurídica.

- Ampliación del plazo de presentación de las autoliquidaciones periódicas. Se podrán liquidar hasta los primeros 30 días naturales del mes siguiente al periodo de liquidación.

- Reducción de los plazos de realización de las devoluciones.

- Reducción de los plazos de comprobación.

- Disminución de los requerimientos de información.

El proyecto SII va dirigido a todos aquellos sujetos pasivos que en la actualidad están haciendo la liquidación mensual del impuesto sobre el valor añadido (IVA). Estos son:- Inscritos en el REDEME, Registro de Devolución Mensual del IVA.

- Grandes empresas con facturación superior a 6 millones de €.

- Grupos de entidades.

- Régimen General.

- Sujetos pasivos que voluntariamente han decidido acogerse.

El envío de información se realizará por vía electrónica. Con la información enviada se irán configurando casi en tiempo real los distintos Libros de Registro del IVA.La información enviada NUNCA será una factura como tal, sino un resumen de la misma. Los datos mínimos obligatorios son los siguientes:- Ejercicio

- Emisor de la factura: Identificador o NIF.

- Número de serie.

- Fecha de Expedición.

- Tipo de Factura.

- Identificador de Régimen Especial, si se necesita.

- Desglose de la factura.

- Tipo de operación.

¿Qué información se debe enviar y Cuándo?Todos los mensajes que se envíen estarán compuestos de:- Cabecera, incluye los datos sobre el titular del libro de registro y el tipo de comunicación al que se refiere la información del siguiente campo.

- Lista de facturas o registros, para cada libro de registro la información a indicar será diferente.

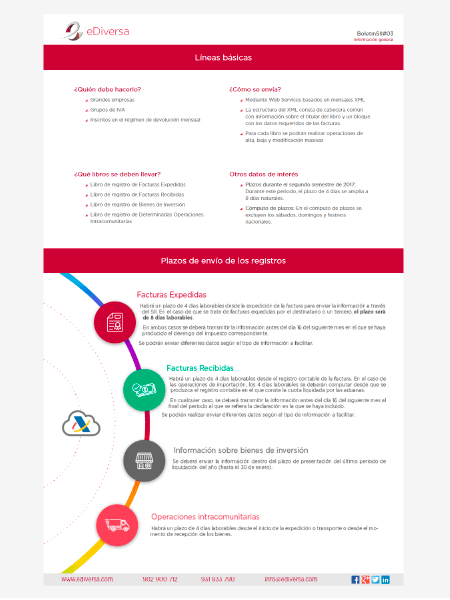

Facturas expedidas

Facturas expedidas Facturas recibidas

Facturas recibidas Información sobre bienes de inversión

Información sobre bienes de inversión Operaciones intracomunitariasHabrá un plazo de 4 días laborables desde la expedición de la factura para enviar la información a través del SII. En el caso de que se trate de facturas expedidas por el destinatario o un tercero, el plazo será de 8 días laborables.En ambos casos se deberá transmitir la información antes del día 16 del siguiente mes en el que se haya producido el devengo del Impuesto correspondiente.Se podrán enviar diferentes datos según el tipo de información a facilitar.

Operaciones intracomunitariasHabrá un plazo de 4 días laborables desde la expedición de la factura para enviar la información a través del SII. En el caso de que se trate de facturas expedidas por el destinatario o un tercero, el plazo será de 8 días laborables.En ambos casos se deberá transmitir la información antes del día 16 del siguiente mes en el que se haya producido el devengo del Impuesto correspondiente.Se podrán enviar diferentes datos según el tipo de información a facilitar. Habrá un plazo de 4 días laborables desde el registro contable de la factura. En el caso de las operaciones de importación, los 4 días laborables se deberán computar desde que se produzca el registro contable en el que conste la cuota liquidada por las aduanas.En cualquier caso, se deberá transmitir la información antes del día 16 del siguiente mes al final del periodo al que se refiera la declaración en la que se haya incluido.Se podrán realizar enviar diferentes datos según el tipo de información a facilitar.

Habrá un plazo de 4 días laborables desde el registro contable de la factura. En el caso de las operaciones de importación, los 4 días laborables se deberán computar desde que se produzca el registro contable en el que conste la cuota liquidada por las aduanas.En cualquier caso, se deberá transmitir la información antes del día 16 del siguiente mes al final del periodo al que se refiera la declaración en la que se haya incluido.Se podrán realizar enviar diferentes datos según el tipo de información a facilitar. Se deberá enviar la información dentro del plazo de presentación del último periodo de liquidación del año (hasta el 30 de enero).

Se deberá enviar la información dentro del plazo de presentación del último periodo de liquidación del año (hasta el 30 de enero). Habrá un plazo de 4 días laborables desde el inicio de la expedición o transporte o desde el momento de recepción de los bienes.

Habrá un plazo de 4 días laborables desde el inicio de la expedición o transporte o desde el momento de recepción de los bienes. Validaciones de la AEATLa AEAT realizará 3 tipos de validaciones:

Validaciones de la AEATLa AEAT realizará 3 tipos de validaciones:- Estructurales: se valida la estructura de etiquetas si no se cumple se producirá un rechazo completo.

- Sintácticas: se valida el formato longitud, obligatoriedad del contenido y valores prestablecidos. Si se produce en una factura se rechaza el fichero parcialmente.

- De negocio: validaciones de campo cuyo contenido u obligatoriedad depende de otro campo. Se pueden considerar como errores admisibles y posteriormente podrán ser subsanables. El resto de errores provocarán el rechazo de la factura.

En eDiversa queremos dar solución a la inminente necesidad de autónomos y empresas de liquidar el IVA de forma electrónica.De este modo, presentamos la solución eDiSII que automatiza los procesos de generación y envío de los libros de registro.eDiSII incorpora, manual o automáticamente, los ficheros necesarios y los traduce al formato requerido por la Agencia Tributaria (XML). Mediante la innovadora plataforma tecnológica de eDiversa, los ficheros son remitidos a la sede electrónica de la AEAT que, a su vez, los validará y almacenará.A través del sistema de respuestas de la AEAT, el cliente obtiene el estado de su registro pudiendo ser: completamente aceptado, aceptado parcialmente o completamente rechazado.Nuestra plataforma, por su parte, garantiza el almacenaje seguro mediante su sistema de custodia de documentos.Beneficios de la Solución eDiSII- Fiabilidad: Registro contable sin errores.

- Seguridad: Mayor control en las transacciones con la Administración Pública.

- Garantía: Custodia legal de los libros de registros contables.

- Eficiencia: Mejora de los procesos de gestión de la empresa.

- Rapidez: Declaración del impuesto en tiempo cuasi inmediato.

- Tranquilidad: Reducción de la incertidumbre ya que se puede conocer el estado de los libros contables en tiempo real.

- Adaptabilidad: Conexión con todas las Administraciones Públicas.

- Ahorro: Reducción de costes en cuanto a gestorías, papel, tinta, envíos

A partir del 1 de octubre de 2019, la AEAT amplía el número y el tipo de validaciones que ejecuta sobre los libros de IVA que realiza a través del SII.Las nuevas validaciones se aplicarán tanto para el libro de Facturas Emitidas como para el libro de Facturas Recibidas.Las validaciones serán las siguientes:- Validación del bloque sujeta/no exenta en el libro de emitidas

- Validación del bloque sujeta/exenta en el libro de emitidas

- Validación del tipo de comunicación A5 y A6 en el libro de emitidas

- Validación del campo <CuotaSoportada> en el bloque <InversionSujetoPasivo> en el libro de recibidas

- Validación del campo <CuotaSoportada> en el bloque <DesgloseIVA> en el libro de recibidas

- Validación del campo <ImporteCompensacionREAGYP> en el bloque <DesgloseIVA> en el libro de recibidas

- Validación del campo <TipoImpositivo> en el libro de recibidas

- Validación del campo <NumSerieFacturaEmisor> en TipoFactura ="F5" y "LC" en el libro de recibidas

- Validación del campo <CuotaDeducible> en el libro de recibidas

A partir del 1 de junio, la AEAT comienza a hacer las pruebas de validación en su entorno de pruebas. Es posible que, a partir de esta fecha, los usuarios reciban más mensajes de error si estos campos no están cumplimentados adecuadamente.eDiversa pone a disposición un entorno de pruebas para la realización de estas.Si necesitas más información acerca de esta novedad, puedes pinchar en el enlace de la Agencia Tributaria aquí.Boletines informativosConsulta, en esta sección, los boletines que publicamos acerca del Proyecto SII. Si quieres recibir los boletines en tu correo o necesitas más información, haz clic aquí.

Boletín SII#13

Boletín SII#12

Boletín SII#11

Boletín SII#10

Boletín SII#09

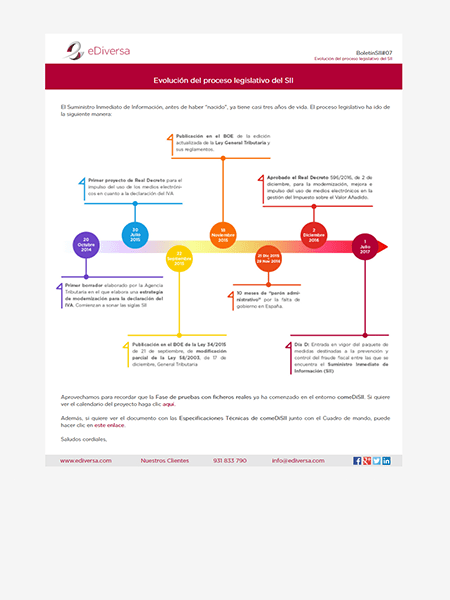

Boletín SII#07

Boletín SII#06

Boletín SII#05

Boletín SII#04

Boletín SII#03

Boletín SII#02

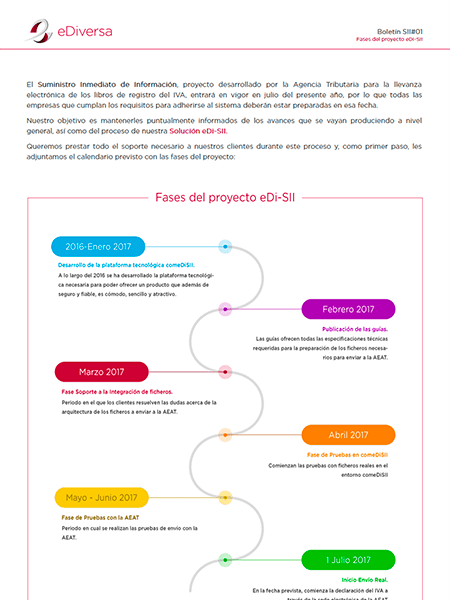

Boletín SII#01

Esta es nuestra sección de Preguntas Frecuentes.

Esta es nuestra sección de Preguntas Frecuentes.

Intentamos resolver aquí las dudas que te puedan surgir. Este es un apartado vivo que pretende ir incorporando las dudas que nos hagáis llegar. Si algo te preocupa y no está aquí resuelto, envíanos un e-mail a info@ediversa.com y te contestaremos lo antes posible.Dudas generalesOptando en la declaración censal (modelo 036) en el mes de noviembre anterior al inicio del año natural en el que deba surtir efecto o al tiempo de presentar la declaración de comienzo de la actividad, surtiendo efecto en el año natural en curso.

Se podrá optar por primera vez al SII en el mes de junio de 2017.

La opción implicará la obligación de autoliquidar el IVA mensualmente.Sí. Deberá permanecer el año natural para el que se opte.Quienes opten por el SII deberán cumplir con el suministro de los registros de facturación durante al menos el año natural para el que se ejercita la opción.

Cumplido lo anterior, se podrá renunciar al sistema en la declaración censal (modelo 036) en el mes de noviembre anterior al inicio del año natural en el que deba surtir efecto.Salvo que el empresario o profesional siga teniendo un período de liquidación mensual:- La exclusión del REDEME supone la exclusión del SII desde el primer día del período de liquidación en el que se haya notificado el acuerdo de exclusión.

- El cese en el régimen especial del grupo de entidades conlleva el cese en el SII desde que se produzca aquel.

10.000 registros.Entrada en vigor: 1 de julio de 2017.

Obligación de enviar los registros de facturación del primer semestre de 2017 en el período desde el 1 de julio al 31 de diciembre de 2017.La solución comeDiSII de eDiversa permite revisar los libros de IVA que la AEAT tiene registrados y el contraste realizado con tus clientes y proveedores. La información se podrá visualizar por meses o años, por tipo de registro (facturas emitidas, facturas remitidas, operaciones intracomunitarias, etc) y realizar filtros por empresa. Todo ello con un diseño exclusivo y de fácil uso para que las consultas resultes sencillas de visualizar y perfectamente comprensibles.Los empresarios o profesionales no establecidos en el territorio de aplicación del Impuesto que tengan la condición de sujetos pasivos con un periodo de liquidación mensual estarán obligados a llevar los libros registro de IVA y, desde la entrada en vigor del Real Decreto 596/2016, deberán llevarlos a través de la Sede electrónica de la Agencia Estatal de Administración Tributaria.

Del mismo modo el SII también será aplicable al resto de sujetos pasivos que, establecidos o no, voluntariamente decidan acogerse al mismo.El nuevo SII será aplicable en los términos que establezca la normativa foral

En el caso de empresarios con domicilio fiscal en una Hacienda foral cuyo volumen total de operaciones en el año anterior hubiera excedido de 7 millones de euros, de las cuales el 75% o más se hubieran realizado en territorio común, aplicarán el SII de acuerdo con la normativa estatal.Hasta la aprobación de la normativa foral correspondiente sólo están obligados al SII los contribuyentes cuya competencia inspectora sea del Estado.

La competencia inspectora es del Estado cuando:- El contribuyente tenga su domicilio fiscal en territorio común y su volumen de operaciones en el año anterior sea menor o igual a 7 MM €.

- El contribuyente tenga su domicilio fiscal en territorio común y su volumen de operaciones en el año anterior sea superior a 7 MM € siempre que realicen algún porcentaje de operaciones en territorio común.

- El contribuyente tenga su domicilio fiscal en territorio foral y su volumen de operaciones en el año anterior sea superior a 7MM € siempre que el porcentaje de operaciones realizado en territorio común sea igual o superior al 75%.

Sí. Deberá comunicarlo mediante el modelo 036 a partir del mes de junio de 2017.En el caso de que haya empresas que realicen pocas operaciones, existe la posibilidad de cumplir con el SII de forma manual a través del formulario habilitado por la AEAT en su sede electrónica.Errores en las facturasNo, solo deben incluirse las facturas que fueron rechazadas.Cuando la factura es correcta pero la anotación en el Libro registro no se ha hecho correctamente, no afectando a los datos de identificación del emisor, número de factura y fecha de expedición (en cuyo caso procederá dar de baja el registro), se enviará un nuevo registro con el número de la factura original y con el tipo de comunicación A1 'Modificación de facturas/registros (errores registrales)'. El suministro de este registro deberá realizarse antes del día 16 del mes siguiente al final del periodo al que se refiera la declaración en la que deba tenerse en cuenta.Cuando se haya producido un error material en la factura (cuando no se cumpla en la factura alguno de los requisitos exigidos conforme al artículo 6 o 7 del Reglamento de Facturación), un error fundado de derecho, una incorrecta determinación de la cuota repercutida o alguna de las circunstancias que dan lugar a la modificación de la base imponible (art. 80 LIVA) deberá emitirse una factura rectificativa cuya información se remitirá indicando tipo de comunicación 'A0' y tipo de factura con las claves 'R1', 'R2', 'R3' y 'R4' según cuál sea el motivo de la rectificación (errores fundados de derecho y causas del artículo 80. Uno, Dos y Seis LIVA, concurso de acreedores, deudas incobrables y resto de causas).

Asimismo, se deberá identificar el tipo de factura rectificativa con las claves 'S- por sustitución' o 'I- por diferencias'. Cuando la rectificación se realice sobre una factura simplificada, la información a remitir implicará indicar el tipo de factura con la clave 'R5' (factura rectificativa simplificada).La información de la factura se remitirá indicando 'Tipo de Comunicación: A0' y tipo de factura con las claves 'R1', 'R2', 'R3' y 'R4'. En el caso de que se rectifique una factura simplificada la clave será 'R5'. Cuando la rectificación se haga por 'sustitución' se deberá informar de la rectificación efectuada señalando igualmente el importe de dicha rectificación. Esta información se podrá realizar:- Opción 1: Informando de un nuevo registro en el que se indiquen los importes correctos tras la rectificación en los campos 'base imponible', 'cuota' y en su caso 'recargo' y a su vez de los importes rectificados respecto de la factura original en los campos 'base rectificada', 'cuota rectificada' y en su caso 'recargo rectificado'.

- Opción 2: Informando de un nuevo registro en el que se indiquen los importes correctos tras la rectificación en los campos 'base imponible', 'cuota' y en su caso 'recargo' y de otro registro en el que se informe de los importes rectificados. La identificación de la relación de facturas rectificadas será opcional.

La información de la factura se remitirá indicando 'Tipo de Comunicación: A0' y tipo de factura con las claves 'R1', 'R2', 'R3' y 'R4'. En el caso de que se rectifique una factura simplificada la clave será 'R5' Cuando la rectificación se haga por 'diferencias' se deberá informar directamente del importe de la rectificación. Para ello se deberá informar en un solo registro de la factura rectificativa con la clave 'I'. En este caso no se deben rellenar los campos adicionales 'Base rectificada' y 'Cuota rectificada'. La identificación de la relación de facturas rectificadas será opcional.La identificación de las facturas rectificadas es opcional. En el caso de que se identifiquen se deberá informar el número y la fecha de expedición. Podrán identificarse todas ellas con la única limitación del tamaño del propio fichero XML.El registro de la factura enviada previamente y que no procede se dará de baja (mensaje 'baja de factura') identificando el número de la factura original. En el caso de que proceda emitir una nueva factura correcta se deberá registrar con un alta (A0) y con un número de factura o fecha de expedición diferente. Cuando se emita una factura rectificativa, no habiendo sido aceptada por el sistema la factura errónea inicial, el emisor deberá registrar una factura rectificativa por sustitución 'S' consignando cero en los campos adicionales 'base rectificada' y 'cuota rectificada'.Deberá cumplimentarse el campo 'fecha de operación' en el Libro registro de Facturas Expedidas cuando la fecha de realización de la operación sea distinta a la fecha de expedición de la factura. Deberá cumplimentarse el campo 'fecha de operación' en el Libro registro de Facturas Recibidas cuando la fecha de realización de la operación sea distinta a la fecha de expedición de la factura y así conste en la misma.El nuevo SII será aplicable en los términos que establezca la normativa foral

En el caso de empresarios con domicilio fiscal en una Hacienda foral cuyo volumen total de operaciones en el año anterior hubiera excedido de 7 millones de euros, de las cuales el 75% o más se hubieran realizado en territorio común, aplicarán el SII de acuerdo con la normativa estatal.Se consignará el último día del mes natural en el que se haya efectuado la operación que documenta la última factura rectificada (la de fecha más reciente).

Tus datos están seguros con nosotros

Tus datos están seguros con nosotros